Originally published in the Spring 2023 issue of Kansas Child Magazine.

Staying Focused on the Bottom Line

Running a successful child care business is not easy. It’s crucial to have a steady flow of revenue to meet payroll, comply with tax withholding requirements, and cover other operating costs. With so many competing demands — from staff, families, funders, regulators, and others — finding the time to focus on cash flow or accurately project and track revenue is a daily challenge.

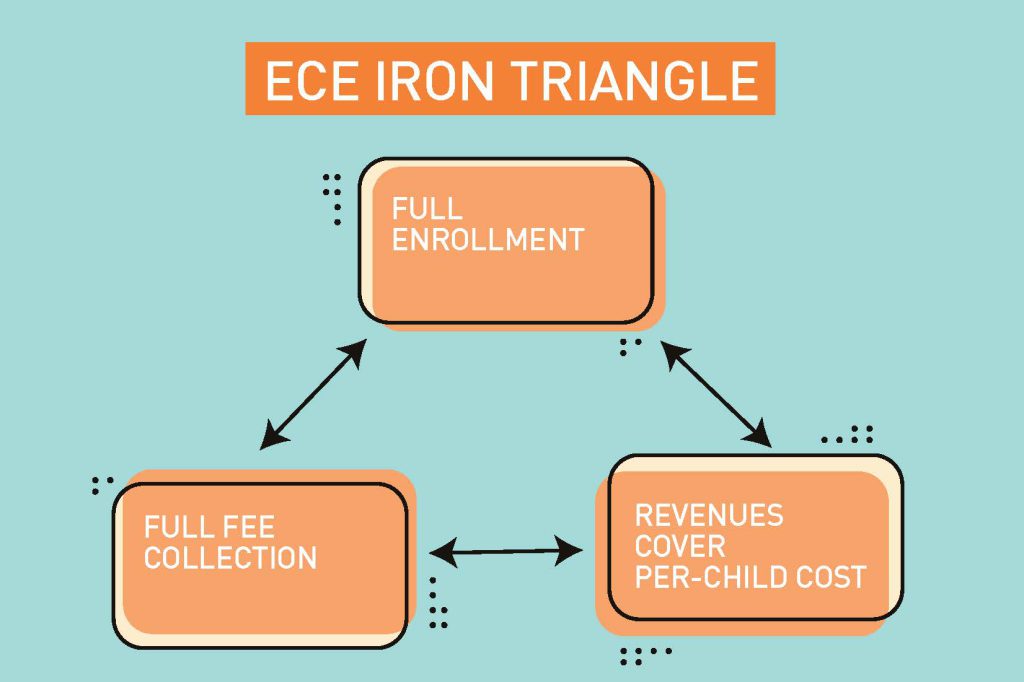

The Iron Triangle of Early Care and Education Finance is a simple formula to help busy child care providers stay on track. The formula focuses on three key metrics — enrollment, collections and unit cost — that can be monitored with reports from the automated systems used to run a child care business every day.

Full Enrollment

Almost all revenue for an early care and education (ECE) program comes from tuition and fees collected on behalf of the enrolled children. While government and philanthropy sometimes help finance ECE, this funding is rarely provided as general operating support in the United States. Typically, the dollars provided by the government — and often philanthropy — are linked to the enrollment of specific children. If the children are not enrolled, the funding does not flow.

Full enrollment is a cornerstone of ECE finance, regardless of whether the program relies mainly on public funds, on parent fees, or a combination.

Unless a program is over-enrolled (a practice that is generally prohibited in licensing regulations because it could result in attendance that exceeds the ratio and/or group size limits), it’s not possible to operate at 100% enrollment. Some experts suggest that a well-run center can operate at 95% enrollment; others suggest budgeting for a more achievable rate, such as 85% enrollment. Regardless of the target, any time enrollment drops below the budgeted target, an ECE program is losing money.

Monitoring enrollment — and acting quickly to address any shortfall — is key to fiscal stability. This means program administrators must track attendance in each classroom on a regular basis and plan in advance for when children will age out of the program or move to a different classroom. Without careful monitoring and active outreach to fill vacant slots, it’s easy for these natural transitions to cause funding gaps.

Tuition, especially when reimbursed by the government, may also be dependent on actual attendance, so staying on top of this is crucial. It’s easy for non-attendance to turn into non-enrollment. In a small program, every day a slot remains open can make a big difference. Over time, these losses add up and can lead to serious financial shortfalls.

The COVID-19 pandemic had a dramatic impact on attendance and enrollment, as well as teacher recruitment and retention. While enrollment is returning to pre-pandemic levels, many programs still struggle to find enough teachers. In short, predicting enrollment in the current environment is a tricky business. And yet it is essential to the bottom line.

Automated child care management systems (CCMS), like those described on page X, offer a host of tools to support online enrollment, waitlist management, electronic documentation, automated check-in/out and more — all designed to make managing and tracking enrollment and attendance less burdensome. Most CCMS also include data dashboards and reports so that, with the press of a button, a busy program operator can view current enrollment and attendance data and trends over time.

Full Fee Collection

Tuition and fees only become revenue when they are collected. All too often, an early childhood program will have a budget that balances on paper, but the cash just doesn’t come in the door. Successful ECE administrators stay on top of fee collection; they have clear policies, are firm and consistent with families and thorough and prompt with billing, and stay on top of the paperwork required by third-party funders. Fee collection can be very time-consuming unless systems are put in place to streamline and automate the process.

Electronic funds transfer (automatic electronic transfer of funds from a bank account or debit or credit card) is the best way to ensure prompt and consistent payment from families. It should be the norm for all tuition and fee collection. The electronic check-in systems supported by CCMS make it possible to create a daily touch point for families — confirming that tuition funds have been transferred or serving as an automated reminder when fees are due or a problem with the electronic transfer has occurred.

Ensuring that tuition is paid by the government or philanthropic entities (e.g., a child care voucher, per-child reimbursement, or scholarship) in full and on time is also essential. Even if you participate in the state EBT swipe card system for the child care subsidy, you still need to maintain your own electronic time and attendance tracking.

It’s essential that child care program operators track and compare what is owed (an invoice or electronic record for every child, regardless of who pays their tuition) against what is paid by the government or philanthropy. Errors are common, especially when payment is based on the child’s attendance or dependent on signatures provided by the parent. In many cases, there is a narrow window of time when errors can be identified and corrected. After this window has closed, it’s not possible to recoup funds even if errors are found. In short, systems to track and reconcile fee collection are essential to business sustainability.

Automated CCMS software not only helps monitor the collection of tuition and fees but can also generate the documentation needed to reconcile payments from the government and philanthropy on behalf of children eligible for financial assistance.

Fees + Third Party Funding = Per-child Cost

Setting tuition and fees accurately involves many factors and decision points, some of which are beyond the control of an ECE program. What parents can afford to pay is based on what they earn and the local cost of living. What the government or scholarship programs will pay is typically based on available funds.

Determining the actual cost per child, comparing this cost to the price charged, identifying when fees cannot cover the full cost, and finding third-party funding to fill the gap — all these tasks are essential to sound fiscal management. The bottom line is that parent fees plus third-party payments must equal per-child cost. If the math doesn’t add up, a program is losing money.

Even when the math won’t work, even when it’s impossible to set tuition at what it actually costs to deliver child care services, it’s essential that program operators understand and document their costs. We cannot solve a problem if we do not fully understand it. Having this data — even if it cannot be acted on right away — is a powerful tool.

Calculating per-child costs is not simple. Infants require a lower child-to-staff ratio, along with special equipment and supplies designed to meet the needs of babies, and all of these costs significantly increase the unit cost per child. The cost of serving school-age children, on the other hand, is typically much lower, since these children can be in larger groups and may not attend for the full day. Enrollment and fee collection also impact actual per-child costs. If a program is not fully enrolled, the per-child cost increases. In short, simply dividing the total budget by the number of children served is not a helpful metric. Providers need a more precise understanding of how cost and revenue differ for each age group.

In some cases, a budget gap can be addressed by boosting enrollment or reducing bad debt, rather than raising fees. The three factors are related. In tough fiscal times, when public funding is scarce and parents are squeezed financially, ECE programs often face a difficult choice: keep fees high and risk increased vacancy rates and more bad debt or reduce fees to boost cash flow. Unfortunately, the right answer is not simple or obvious, and it may vary from center to center based on the services offered and the families served.

ECE Resources Kansas — a one-stop location for ECE policies, forms, regulations, guidance, and more — offers a set of tools that can be downloaded and customized to help track Iron Triangle metrics, including a tool specifically designed to help calculate the unit cost per child.

Another option is to use one of several online cost calculators, such as the interactive tool provided by the Center for American Progress or other cost-modeling resources available from P-5 Fiscal Strategies. Increasingly, ECE business coaches are using these tools, and others like them, to help providers calculate the unit cost of care. In some states and cities, ECE Shared Service Alliances are available to assist with Iron Triangle metric management.

While balancing the Iron Triangle of ECE Finance can be a challenging task, the potential results are significant. Indeed, nearly every program operator who has put systems in place to track Iron Triangle metrics and make changes based on the data has found that revenue increases — in some cases, quite dramatically. In addition to serving as an internal dashboard to guide decision-making, financial management tools based on the Iron Triangle can help program administrators better communicate with boards, funders, and public sector partners about what changes are needed to ensure program sustainability.

-

Louise Stoney

Opportunities Exchange

Louise is an independent consultant specializing in early care and education finance and policy (Stoney Associates) and the co-founder of both Opportunities Exchange and the Alliance for Early Childhood Finance. Louise has spent her career focused on innovation. She devised the Iron Triangle of ECE Finance as a framework to guide practitioners and policy. She has also encouraged and guided efforts to maximize the power of technology and has helped model ECE program costs to deepen understanding of both administrative and direct services.